Information Possibly Outdated

The information presented on this page was originally released on January 11, 2016. It may not be outdated, but please search our site for more current information. If you plan to quote or reference this information in a publication, please check with the Extension specialist or author before proceeding.

Make a resolution to be financially smart this year

STARKVILLE, Miss. -- Creating a reasonable spending plan and reducing debt should be top priorities when it comes to living a well-budgeted life.

Rita Green, assistant Extension professor and state specialist for financial management in the Mississippi State University School of Human Sciences, said developing a budget helps families establish a vision for their spending.

“By determining financial conditions before spending money, families can make adjustments with their income or expenses to avoid taking on debt,” she said. “The solution for meeting budget goals, if there is a deficit, could be holding a garage sale or taking a temporary or part-time job for extra money to increase income. Another option is to decrease some other expenses and apply that money to the deficit.”

Green said a family’s goal should be to spend less than what it earns and consistently save money.

“A surplus in the spending plan means success in spending less than what is earned, which is a perfect opportunity to open a savings account,” she said. “A savings account provides a cushion to support the household when unexpected expenses occur. You can start by taking the pledge to save as part of the Mississippi Saves campaign via http://mississippisaves.org/.”

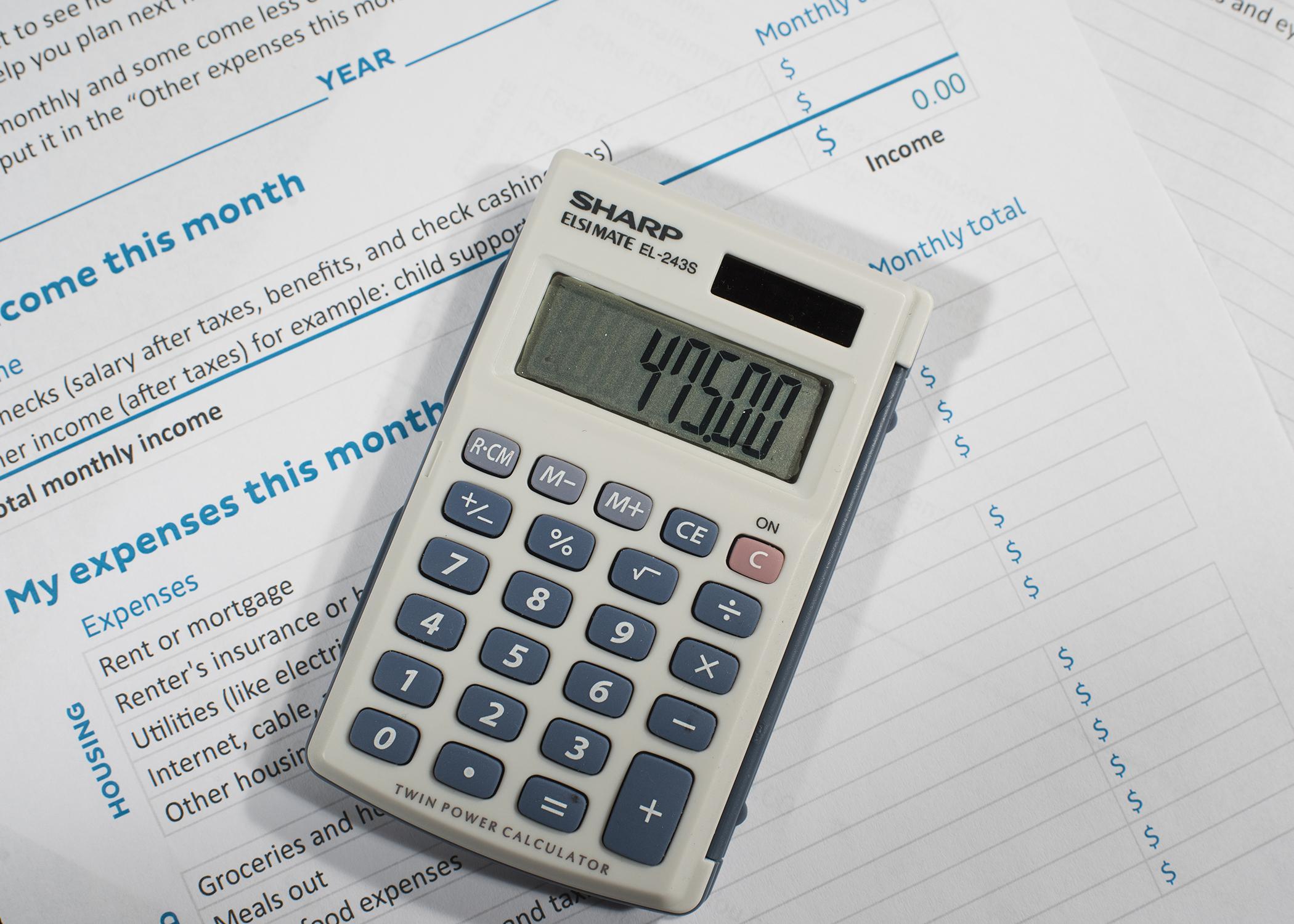

Susan Cosgrove, an MSU Extension Service agent in Newton County, said the best way to create a budget is to write it out and apply it on a month-to-month basis.

“Start by writing down all of the family’s income and how often money is coming in. Then, list all expenses,” she said. “Out-of-pocket spending can cause a strain in the budget if not tracked properly. When you have a good picture of what is being spent, then you can calculate a budget.”

Cosgrove’s advice for budgeting is to focus on needs rather than wants.

“Check your bank accounts frequently to know what and how much is being spent,” she said. “Monitor debit cards carefully and check them online often.”

Communicating with the family about money is extremely important.

“Everyone should know the financial situation to better understand the budget,” Cosgrove said. “Teaching kids to manage money at an early age will help them to understand the responsibility of the financial situation of the family.”

High utility bills can cause a budget to become disorganized and out of balance. Cosgrove said using utilities wisely is always the best option.

“Do not set the thermostat too high during the winter time. Be sure there are no leaks in the home so the cold air does not come in,” she said. “Some utility companies will do audits to make the home more energy efficient.”

The new year brings many new issues with it, holiday debt included.

“If credit is being used during the holidays, it should be paid off within 90 days,” Cosgrove said. “If monthly payments are being made, try to make weekly or automatic payments to pay down holiday debt quickly.”

Cosgrove suggested a debt reduction program created by the Extension Service. PowerPay helps people focus on one debt at a time. As soon as one debt is paid off, apply the monthly payment from that debt to the next one. This method causes the bills to be paid off more efficiently. During this time, avoid creating new debt.